Sean Munger

Historian - Teacher - Author - YouTuber

In addition to my historical videos on YouTube, I teach history courses online at this site, and I also teach and speak in person. Current course offerings are here.

NEWS / WHAT'S HAPPENING:

A new online course, "The Origins of 9/11," is available for registration (the course opens November 11, 2024). Click here to register.

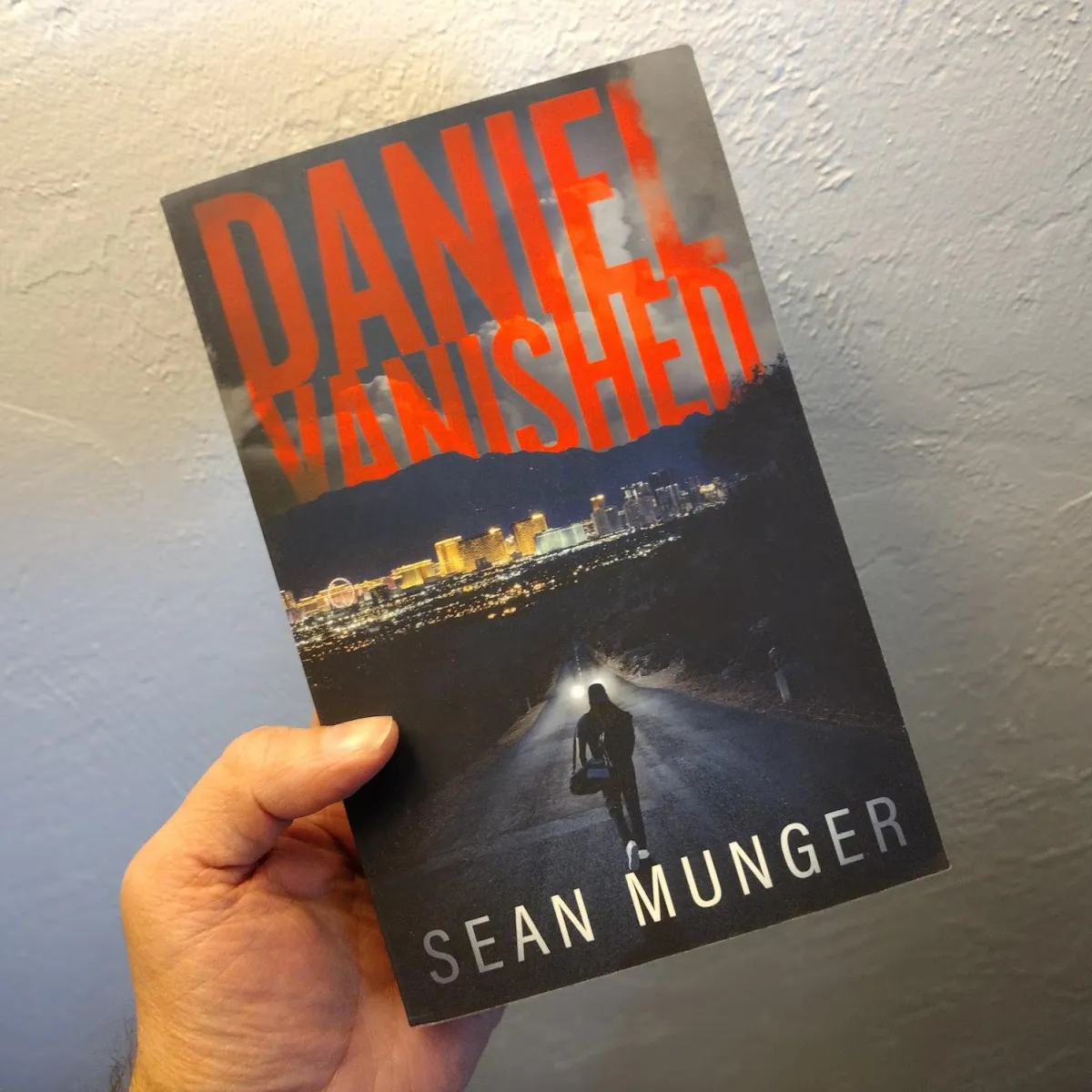

My Books

I have written a variety of books, including fiction in several genres including mystery, thriller and science fiction. I have also written nonfiction on history and climate change.

My Blog

Sign up for my blog and newsletter, The Garden of Memory, on which I run articles about history, current events, movies and more.

Podcasts

I am an experienced podcaster, and I am the creator and host/co-host of the historically-based podcasts "Green Screen" and "Second Decade."

Contact Me

To get in touch about media appearances, live speaking events, sponsorship inquiries, or anything else, contact me via email.